Visual Lease, LLC (hereinafter “VL,” “we,” “our,” and “us”) appreciates being given an opportunity to comment on the Exposure Drafts published by the International Sustainability Standards Board (hereinafter the “ISSB”) in March 2022. VL supports the direction of developing consistent sustainability reporting standards, as consistency in standards is necessary to permit users to analyze and understand entity disclosures. In the United States and globally, more entities have responded to the growing information needs of stakeholders by implementing disclosure practices for non-financial information. This information has been inconsistently presented, however, and is therefore of limited usefulness. We hope that the IFRS Foundation’s work on setting out sustainability reporting standards will help create a high-quality and consistent corporate reporting system, which when used in combination with existing financial reporting, presents meaningful and useful information to the public. We welcome the publication of the ISSB’s two Exposure Drafts of standards for the disclosure of sustainability-related financial information, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate Related Disclosures.

Visual Lease Response

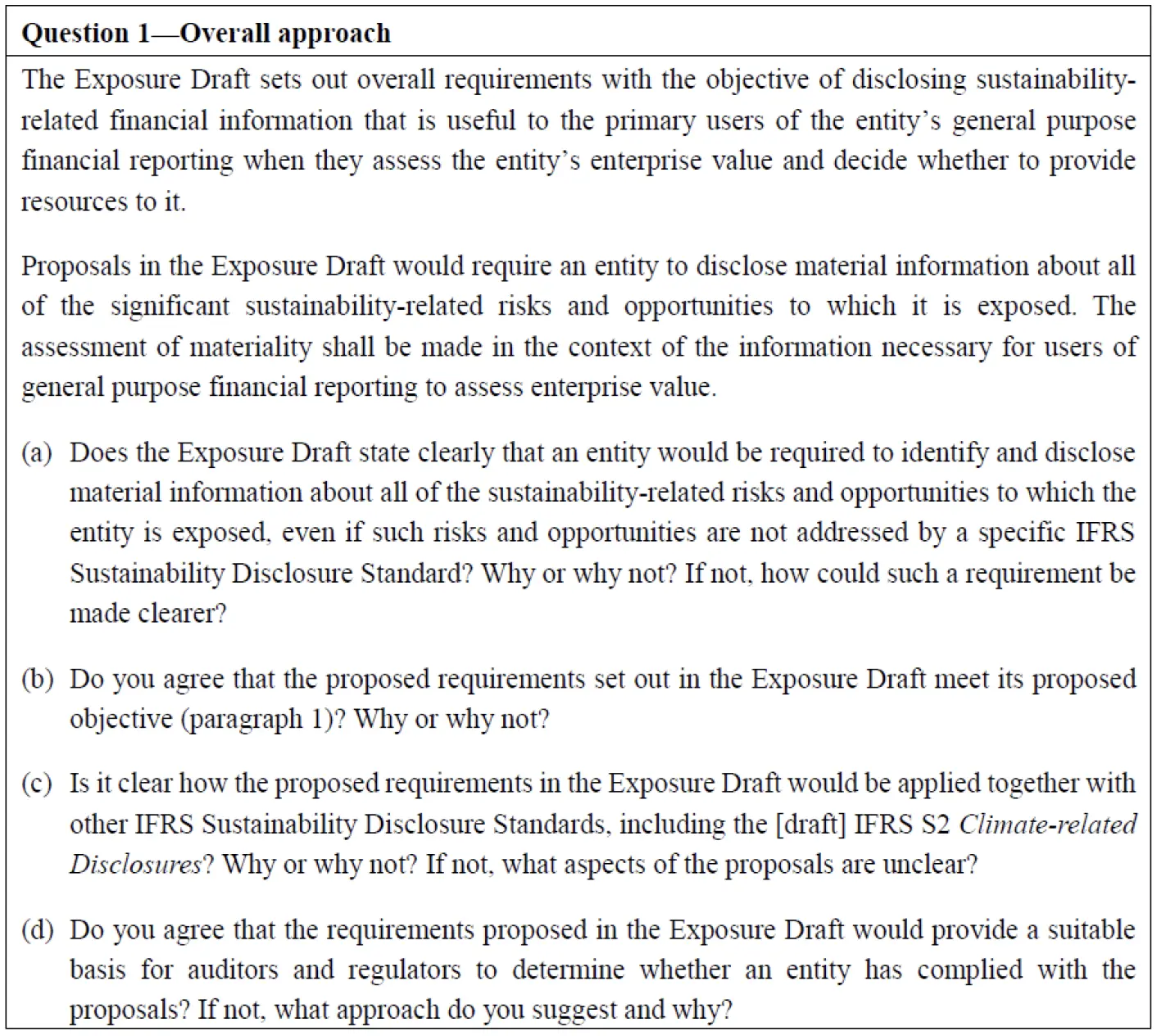

Overall, VL believes this Exposure Draft to be clear, understandable, and capable of meeting its objectives. Our overarching concern is that standards be developed which will enable auditors, regulators, and other stakeholders to not only assess a single entity’s environmental impact on its enterprise value, but to make relevant comparisons among entities. The standards must be consistently applied globally. While variations may be necessary based on industry or the types of activities measured, political boundaries should not be a consideration. This Exposure Draft meets those standards and clearly states that an entity would be required to identify and disclose material information about all of the sustainability-related risks and opportunities to which the entity is exposed.

There are some minor issues we address in response to specific questions, but overall we consider this standard well developed.

Visual Lease Response

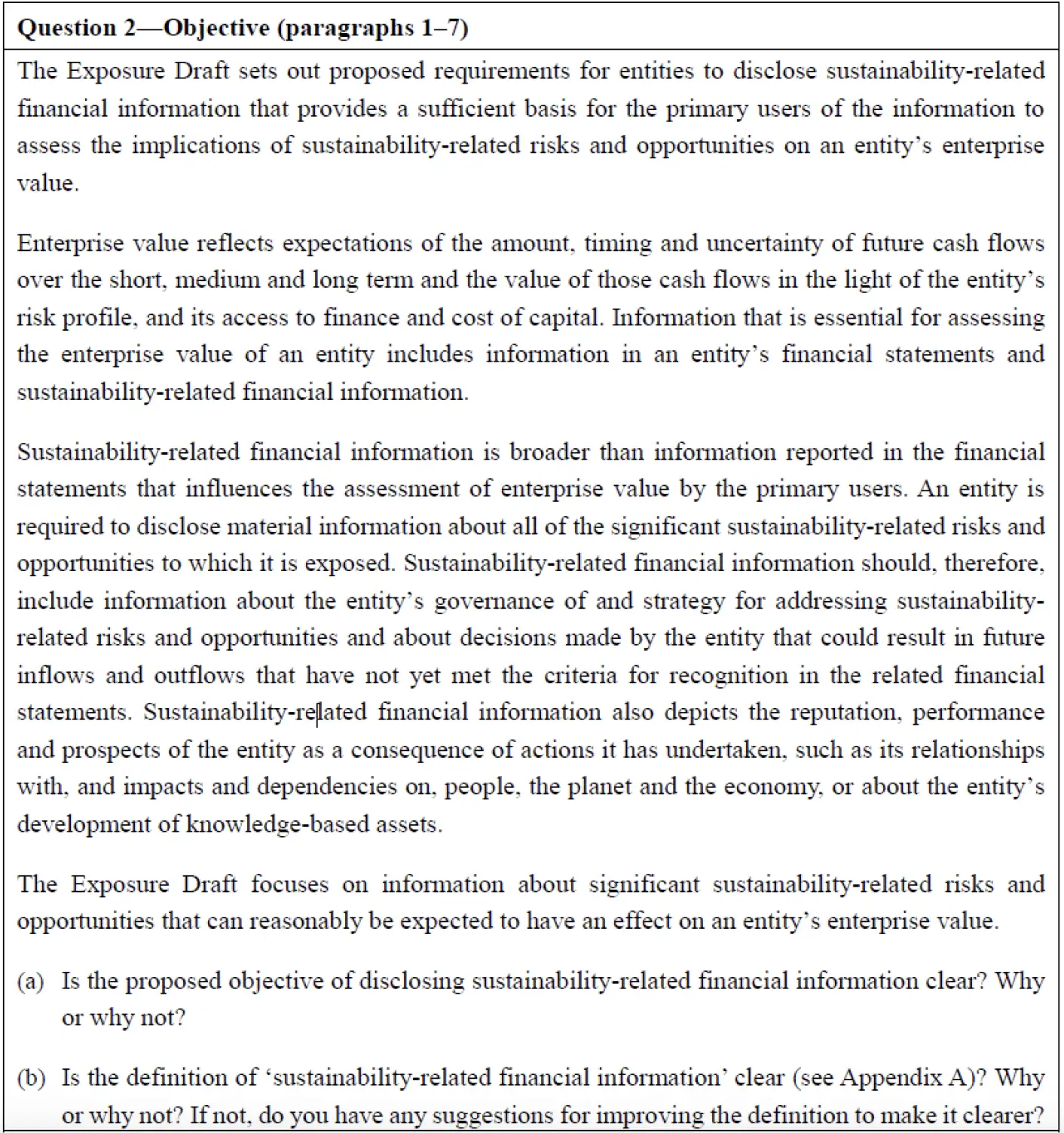

Overall, Visual Lease finds the objective to be clearly stated. The broad objective of Paragraph 1 is supported and explained well by most subsequent paragraphs, although the contents of Paragraph 6 (c) and (d) are more vague than we would like. A statement such as, “its relationships with people, the planet and the

economy, and its impacts and dependencies on them,” does not provide clear prescriptive direction to entities. We would instead desire to see the standard address the relationship between the IFRS Sustainability Disclosure Standards as a global standard and country- or region-specific standards. We find the definitions used in the Objectives section to be clear.

Visual Lease Response

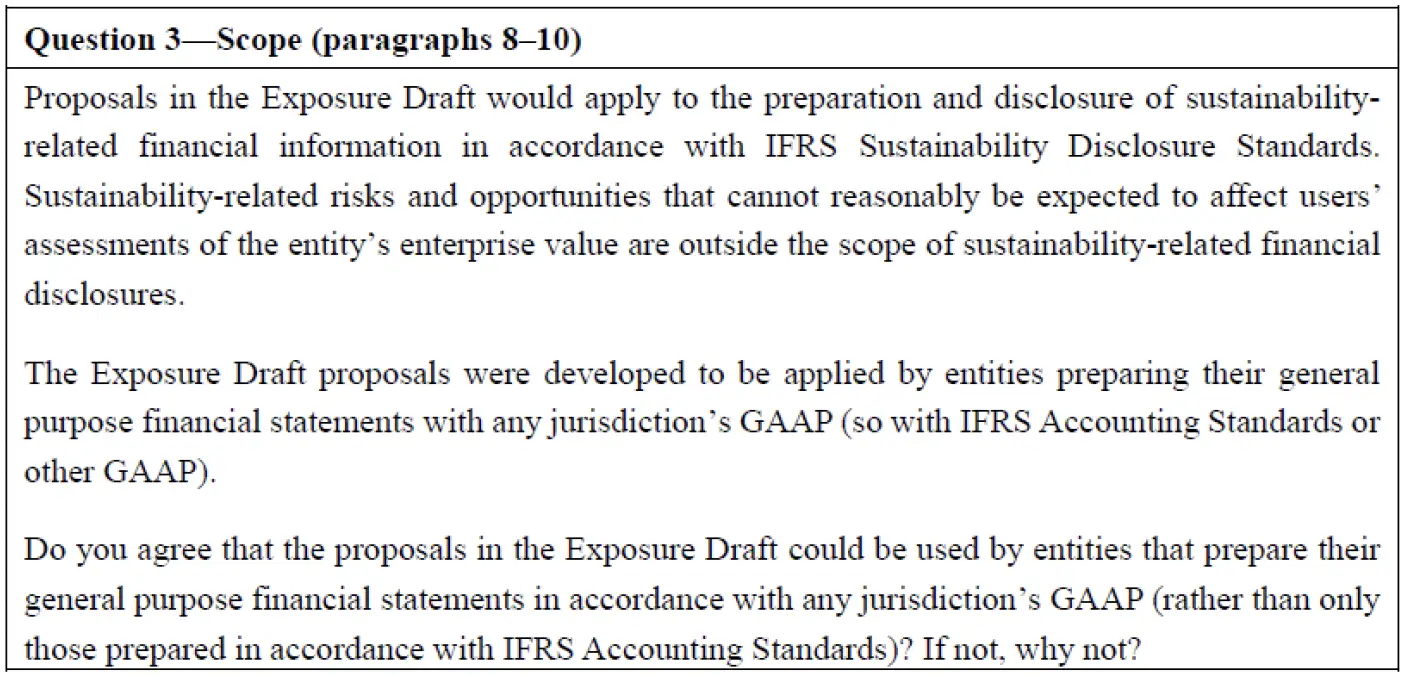

Visual Lease supports the application of the standards across any jurisdiction’s Generally Accepted Accounting Principles (GAAP). By its very nature, environmental issues apply globally and do not respect any political (or geographic) boundaries. While we recognize that the nature of different business enterprises may require differences in approach, as is contemplated here by the recognition of modifying some disclosure items for not-for-profit entities, the overall objectives must remain consistent.

Visual Lease Response

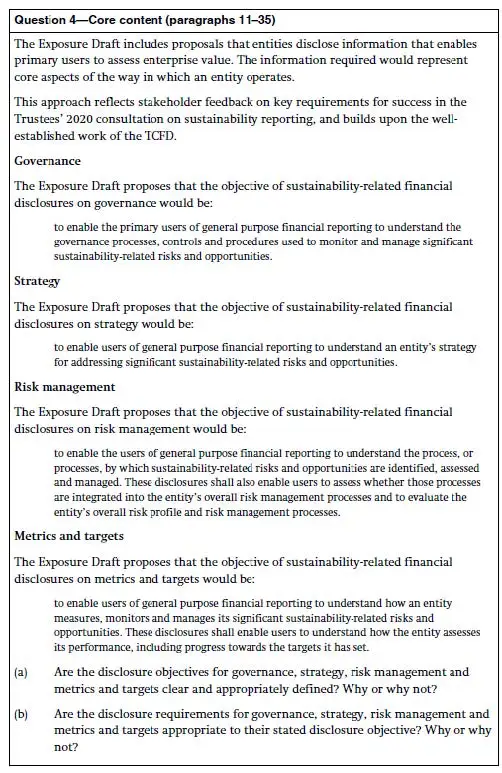

We find the objectives to be clear and appropriately defined. While individual metrics and targets may well evolve over time, the objectives give a clear and consistent framework. Establishing very detailed industry-specific metrics would be inconsistent with the objectives of the standard: to be able to provide the users of information a sufficient basis to assess the implications of sustainability-related risks and opportunities on the entity’s enterprise value. Overall, we believe that the ISSB has struck an appropriate balance between goals and specific requirements that enable primary users to assess enterprise value.

Visual Lease supports the flexibility to report metrics either as an absolute measure or in relation to other metrics. This will allow information to be analyzed and understood by users in industry- or company-specific ways, enhancing the usefulness of the data.

Visual Lease Response

Environmental disclosures should be provided for the same reporting entity as for the related financial statements. While we generally support the provisions about sustainability-related risks and opportunities related to activities, interactions, and relationships, we believe the reference to “investments it controls” in paragraph 40(c) leaves unanswered questions. We generally support the use of the GHG Protocol approaches (equity share, financial control, operational control) and agree with its use here, but we believe some additional clarification may be required. Further, we believe that the “use of resources along its value chain” makes sense

and adds some clarity to the economics, but also may have unanswered questions in practice.

Visual Lease Response

The requirement on the need for connectivity between various sustainability-related risks and opportunities is clear. The presentation of environmental risks and opportunities requires a complex set of estimation and analysis. Visual Lease believes that identifying and explaining these connections will aid users in understanding of the data presented. Without this additional explanation, transparancy could be reduced instead of enhanced, which is contrary to the objectives. Visual Lease expects that implementation guidance will be required after release of official guidance, but that timely release of the guidance is imperative.

Visual Lease Response

Visual Lease believes that by starting with the application of the IFRS Sustainability Disclosure Standards entities will have a clear reference point for disclosure. The ability to provide additional disclosures to supplement the standards will provide value to users. The principles outlined in Paragraphs 48 and 49 are paramount to creating useful disclosure. We believe the guidance in Paragraphs 50 through 55 to be reasonably complete, with the provision that it should not be considered exhaustive. The ability to present information which is relevant and useful, as outlined in Paragraphs 46 and 47, must be maintained.

Visual Lease Response

VL believes that while the definition of materiality is generally clear, there is potentially too much lattitude given to entities to apply judgement in determining thresholds. While we trust that most entities will apply the standard faithfully and consistently with the objectives of the standard, an unscrupulous entity could use materiality to obfuscate pertinent data.

When information could be presented for multiple reporting entities,VL believes the standard established in Paragraph 37 should apply to materiality. If the sustainability-related financial disclosures should be for the same reporting entity as the related general purpose financial statements then the same materiality thresholds should apply to both.

VL does agree with the proposal to relieve an entity from disclosing information

otherwise required by the Exposure Draft if local laws or regulations prohibit

the entity from disclosing that information as a general principle. We do not have sufficient information as to the potential application of this rule to make further comments.

Visual Lease Response

We agree with the proposal that the sustainability-related financial disclosures would be required to be provided at the same time as the financial statements to which they relate. We specifically wish to affirm our support of Paragraph 70, relating to interim reporting.

Visual Lease Response

Visual Lease agrees with the proposals about the location of sustainability-related

financial disclosures. The approach of deliberately avoiding a requirement to provide the information in a particular location within the general purpose financial reporting is acceptable when combined with the requirement to ensure that the sustainability-related financial disclosures are clearly identifiable and not obscured by that additional information. This further extends to the proposal that information required by IFRS Sustainability Disclosure Standards can be included by cross-reference provided that the information is available to users of general purpose financial reporting on the same terms and at the same time as the information to which it is crossreferenced.

Visual Lease Response

VL is concerned that users be able to apply data consistently across periods in order to draw meaningful conclusions. The provisions of Paragraph 64 quantify the difference and explain the reason for the difference, and should be sufficient in

most cases to protect the interests of the users. It is our belief that data be as accurate as possible: so, any time a better measure of a previously reported metric is available we support its use and proper disclosure.

Overall, we support alignment of sustainability-related disclosures with financial disclosures.

Visual Lease Response

VL agrees with this proposal. The requirements for any statement of compliance should be equivalent between financial statements and sustainability disclosure statements.

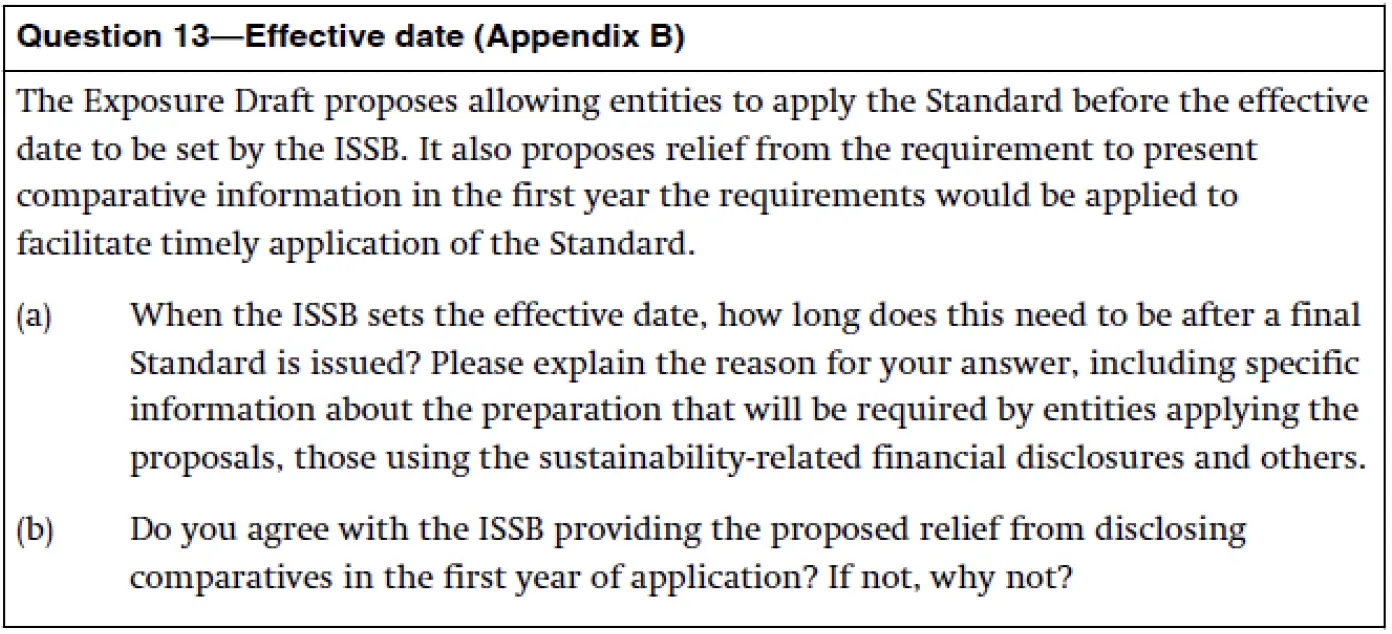

Visual Lease Response

Visual Lease recognizes that adoption is a complex issue with no simple answer. We can look to our experience of adopting software for the new Lease Accounting requirements (IFRS 16, ASC 842) for some guidance. The changes to lease accounting were less extensive compared to the scope of Draft S1, and approximately three years passed between adoption and the effective date.

On the other hand, we also recognize the imperative in many jurisdictions to pass some sort of standard quickly. We support the ISSB taking a leadership role in this issue, and so we do not suggest taking a longer approach. However, a phased implementation may be preferable. For instance, capturing and reporting Scope 1 and Scope 2 Greenhouse Gas Emissions is a relatively straightforward exercise and could be implemented sooner. Understanding the proper horizon for Scope 3 issues is more challengeing, much less estimating those emissions: the effective date may take longer. Estimating the financial statement impact of hyppothetical environmental events requires extensive modeling, and therefore might best be phased in over time.

In any event, VL supports a provision to permit and encourage early adoption of the standards. We would encourage the ISSB to leave open the possibility for individual jurisdictions to use an adoption waterfall, where the largest entities would adopt first, followed by successively smaller entites. By this method, the entities with the most resources to apply to the efforts can model and test the standards. The lessons learned from their implementation would then lessen the expense on smaller enterprises who are less able to bear the cost.

We further support proposed relief from disclosing comparatives in the first year of application. We are concerned that entities might delay adoption until at least two years of reliable information are available. We support adoption in the first year reliable information is available. However, if an entity has made prior disclosures, we support using that information as comparative. If the prior disclosures do not comply with the new standards, we believe the comparison would still benefit users if the different methodologies are adequately explained.

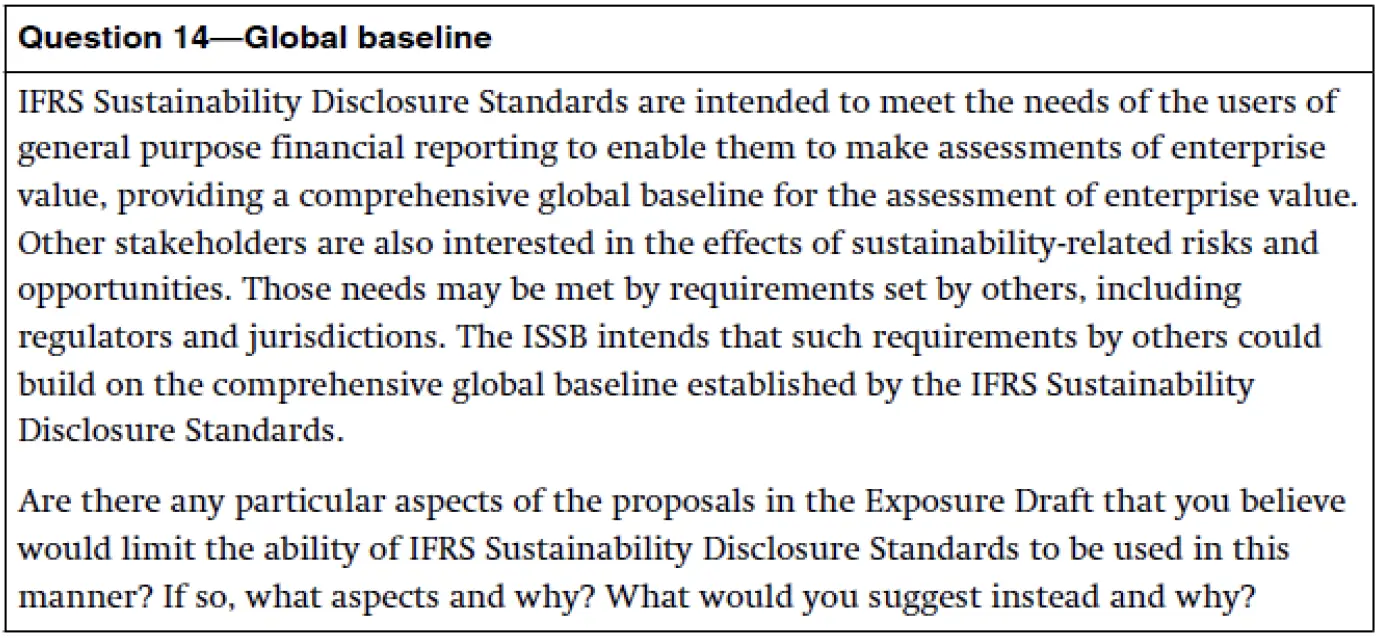

Visual Lease Response

Visual Lease supports initiatives to establish globally consistent sustainability information disclosures. Environmental issues are truly global issues, and require a consistent application across all borders.

As stated in our response to Question 13, we believe timing is probably the most important consideration that could limit the ability of Draft S1 to be used as a global baseline. The last standard to the playing field cannot become the baseline. For that reason we support a quick but measured path to an effective date.

VL believes a building block approach is best suited to achieving this global baseline standard. First make effective those parts of the standard which are easiest to implement. Add the levels of complexity as the standards evolve. We contend that this accretive approach is the most effective way to make this standard the global baseline.

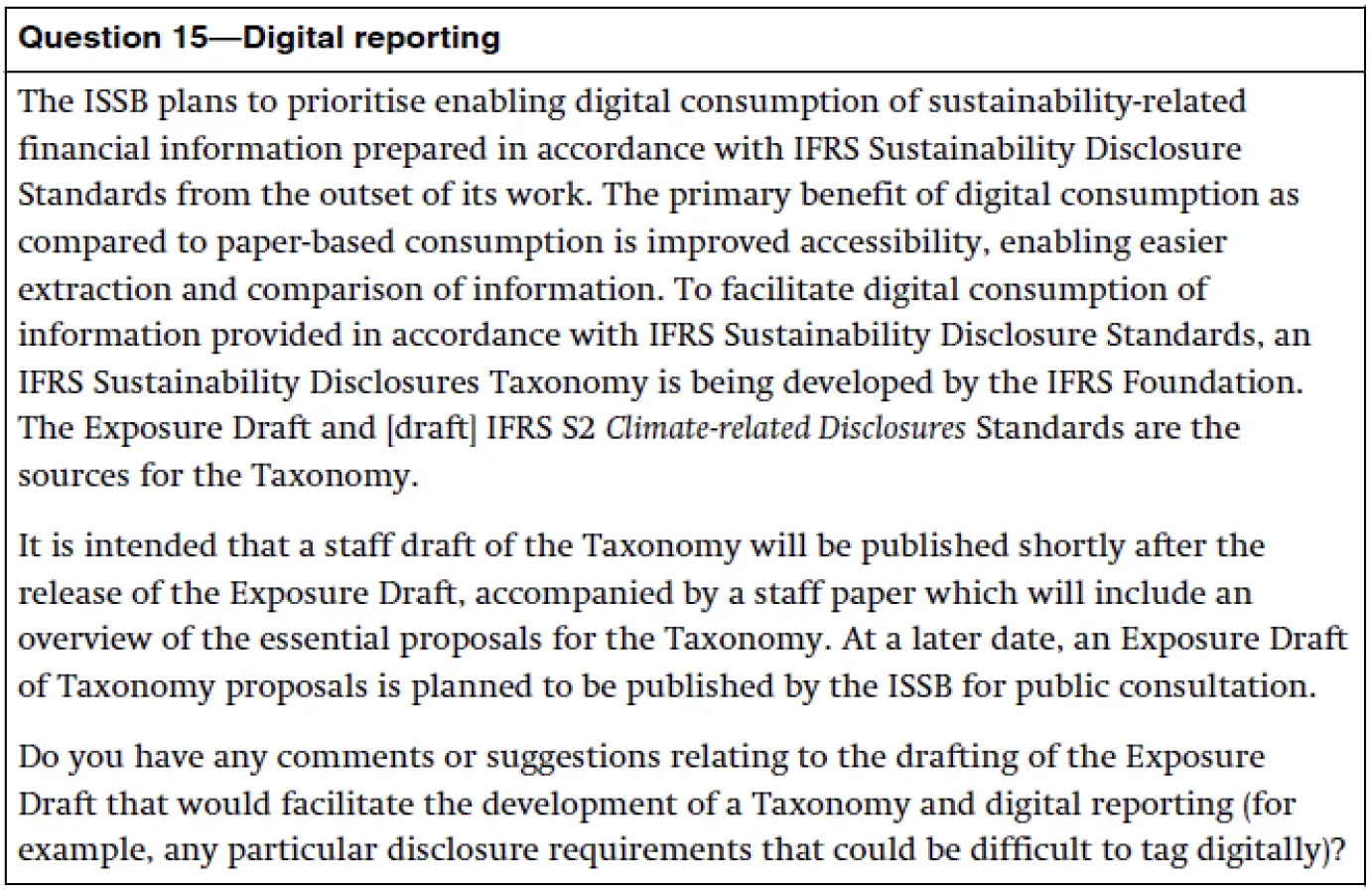

Visual Lease Response

We only suggest the approach to digital reporting be consistent with the current approach to financial reporting.

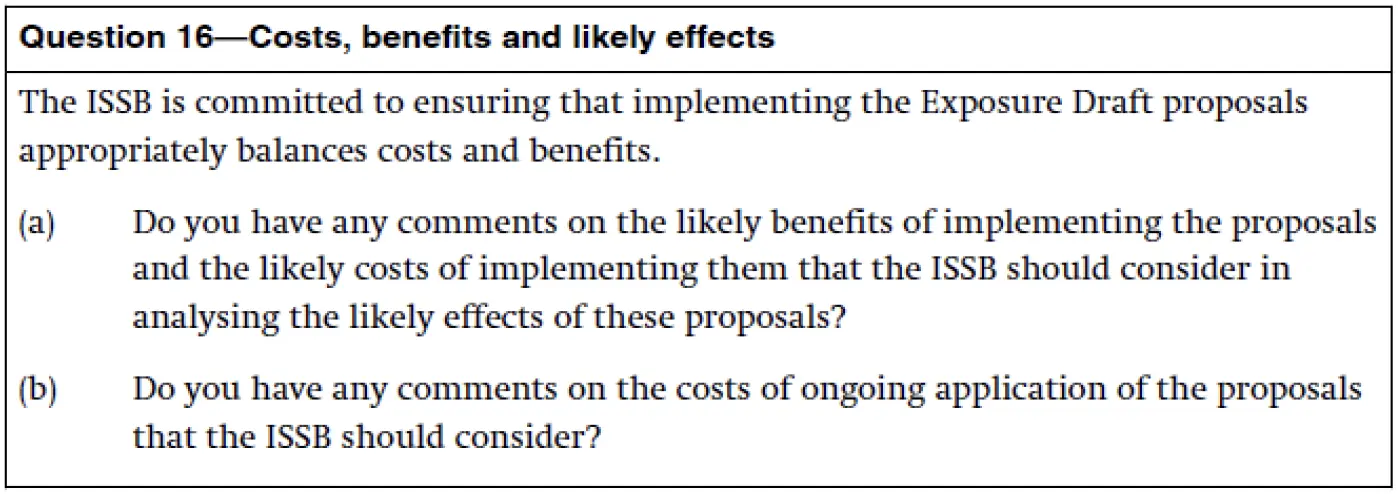

Visual Lease Response

Given the breadth and extent of the disclosures proposed, we can safely say that the costs of compliance will be high. We have seen estimates of 1,300 person hours per year to meet compliance requirements.1 We cannot speak to the accuracy of that number, but our experience with the adoption of Lease Accounting policy changes (IFRS 16, etc.) is illustrative.

There is a significant cost initially to gather the required information and to set up the processes to meet the requirements. In the United States, the effort was so significantly higher than estimated that implementation for Private Business Entities was deferred a year to permit sufficient time.

Entities who initially tried to capture the required information in Excel spreadsheets found the workload to be extremely high, and the risk of errors very high as well. Costs went down and accuracy increased as compliance software became available.

Visual Lease Response

Visual Lease has no further comments.

Respectfully Submitted,

Joseph Fitzgerald

Senior Vice President, Lease Market Strategy

Visual Lease

William Harter

Principal Solutions Advisor

Visual Lease

1. Jill Klindt, “ESG reporting requires the right people and processes”, Accounting Today, July 20, 2022

See it in Action

See it in Action